Emily Rusch

Vice President and Senior Director of State Offices, The Public Interest Network

Vice President and Senior Director of State Offices, The Public Interest Network

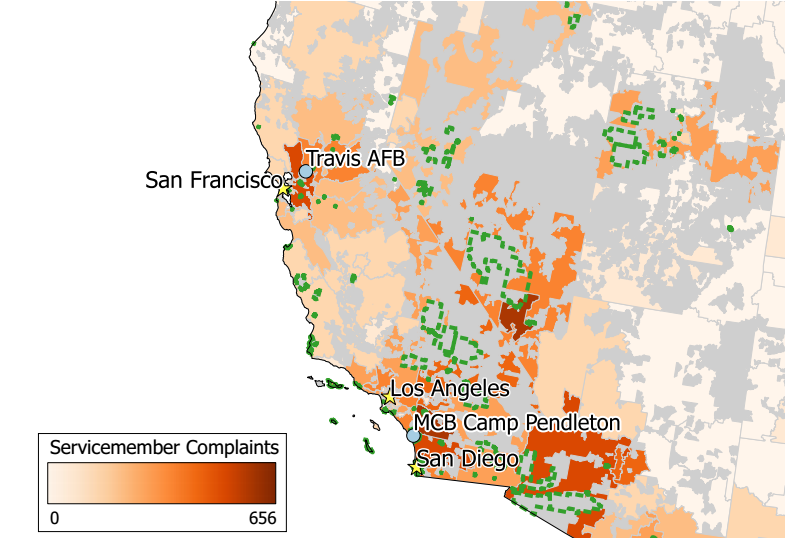

Oakland, CA – Debt collection abuses were the leading source (32%) of 44,000 servicemember complaints to the Consumer Financial Protection Bureau, according to a new report. And one of the top five servicemember complaint “hot spots” identified in the report is California’s 925– zip code region that includes Riverside, Hemet, and Temecula, just north of Camp Pendleton and surrounding the March Air Force Base.

Further, legislation on the House floor this week intended to cripple the CFPB would place servicemembers, veterans and their families in “financial harm’s way,” thereby threatening unit preparedness. The bill, HR 10, the so-called Financial Choice Act, but more aptly called the “Wrong Choice Act,” rolls back the powers, funding and independence of the CFPB and it also weakens its pioneering Office of Servicemember Affairs. The bill also eliminates many other financial system reforms of the 2010 Dodd-Frank Act enacted after the second-worst financial crisis in the nation’s history.

“The CFPB has already taken at least 12 major enforcement actions against financial firms targeting young servicemembers, older veterans and their families,” said Emily Rusch, Executive Director of CALPIRG. “Gutting the CFPB puts those who protect us in financial harm’s way. That also threatens unit preparedness and mission capabilities because delinquent debt and bad credit reports are a leading cause of revoked security clearances.”

“As the Company First Sergeant for a Military Police Company, I was constantly dealing with the predatory practices and unfair, and sometimes illegal, treatment of my Soldiers,” said Bill Randolph, retired U.S. Army 1st Sgt. from Sacramento. “Being a Military Police Company, all of my Soldiers were required to maintain their Security Clearance, so when a creditor would threaten to mess up one of my Soldiers credit report, it truly would create a crisis situation. The CFPB has acted time and again to correct wrongs and protect Soldiers from predatory financial practices.”

“The CFPB is a vital line of defense for service members, veterans and their families against predatory financial practices. These financial crimes have lasting consequences, and increase the risk of unemployment, homelessness, family dissolution and mental distress for our veterans. The CFPB has acted to right these wrongs and should be strengthened rather than gutted.” Amy Fairweather, Director of Policy at Swords to Plowshares in San Francisco.

Among the key findings of the CALPIRG Education Fund/Frontier Group report “Protecting Those Who Serve: How the CFPB Safeguards Military Members and Veterans from Abuse in the Financial Marketplace” are the following:

“Predatory lenders cluster their storefronts around military bases, putting their operations in the path of servicemembers and their families,” said Gideon Weissman of Frontier Group, a report co-author. “Not surprisingly, complaints to the CFPB cluster around the bases as well.”

The report also includes excerpts from servicemember complaint narratives. Since the database began accepting these optional narrative stories, about half of complaints include them.

For example, this servicemember’s complaint submitted from Kern County, California in April 2016, highlights the unique difficulties that some servicemembers have as a result of living overseas: “I have a few debts that are under my name, all this happen during my military career and I was not aware of such things going on…It’s not me, I was overseas…or living in a different state during that time. I decided to get a credit report…that’s when I seen all this identity theft and debts that are not mine.”

Another consumer complaint, submitted from the San Diego region also in April 2016, highlights the elevated consequences for active duty members, who could lose their security clearance because of a mistake: “During an interview last week with a federal agent to renew my security clearance with the federal government, I was made aware of negative entries on my credit report…As you can see from the attached documentation and from the notes in the previous case, this debt was never mine and was eventually cleared…However, now it is directly affecting my credit rating, and worse, it may potentially affect my security clearance and therefore my prospects for future employment.”

In conclusion, Rusch noted that “The so-called Financial Choice Act is the wrong choice for military families and all consumers because it takes away the CFPB’s tools to protect us, allowing financial predators to run amok.”

Map of Servicemember Complaints by Region: